We know that navigating payroll can feel like threading a needle in a hurricane. Most companies today lean towards payroll apps to file and manage their payments, as online payroll services are often cheaper, faster, and more reliable than human accountants.

However, there are numerous options to choose from. Some of them are good, some underdeliver, and some won’t just give you what you need. We know about the mess, and we are here to assist you in dealing with it.

You don’t need to go through payroll software trials or hours of research to figure out which payroll app for small businesses is the right one for you. You just need to read on. By the end, you’ll know which payroll provider to choose.

EXPLORE ONE OF THE BEST PAYROLL APPS TODAY

The Best Payroll Services for Small Businesses (2025)

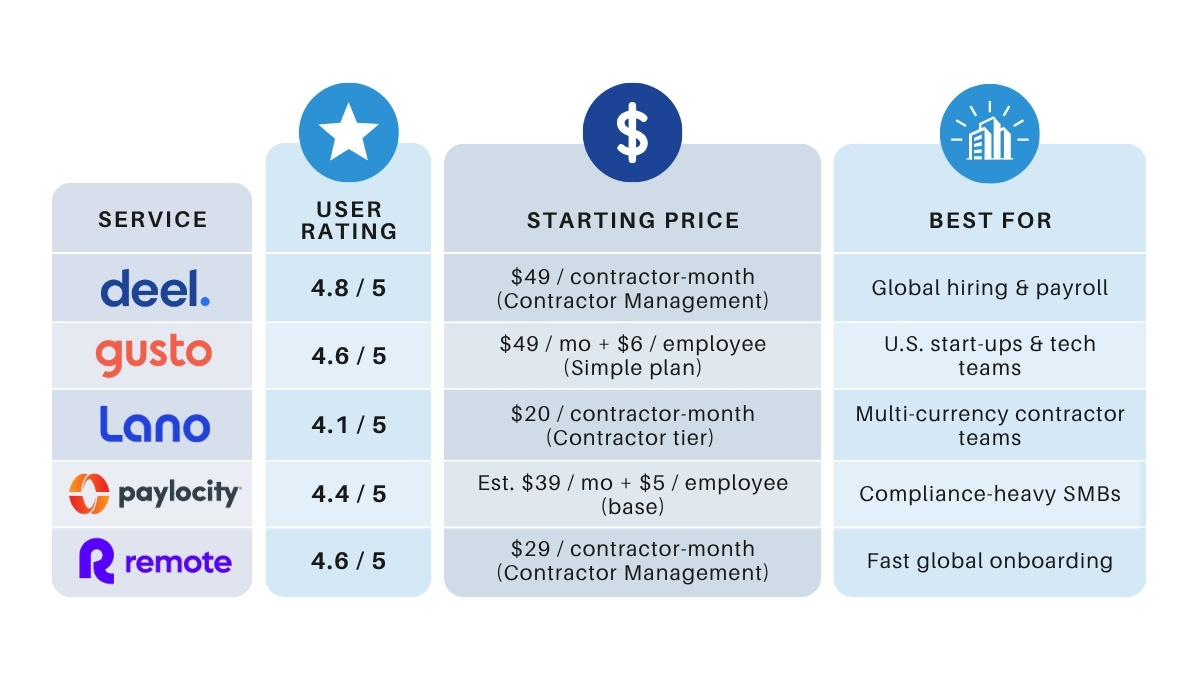

Before we dive into the details, let’s give a snapshot of the best payroll companies for small businesses:

| Service | User rating | Starting price | Best for |

| Deel | 4.8 / 5 | $49 / contractor-month (Contractor Management) | Global hiring & payroll |

| Gusto | 4.6 / 5 | $49 / mo + $6 / employee (Simple plan) | U.S. start-ups & tech teams |

| Lano | 4.1 / 5 | $20 / contractor-month (Contractor tier) | Multi-currency contractor teams |

| Paylocity | 4.4 / 5 | Est. $39 / mo + $5 / employee (base) | Compliance-heavy SMBs |

| Remote | 4.6 / 5 | $29 / contractor-month (Contractor Management) | Fast global onboarding |

What Does an Online Payroll Service Do?

An online payroll system is a software that automatically calculates wages and directly pays employees while withholding federal and Delaware state taxes. It files all the forms, tracks deadlines, updates rates, and stores digital W-2s and 1099s to ensure you’re audit-ready.

Deel – Best One-Stop Global Payroll Platform

Deel stands out as the best payroll software for businesses in Delaware, especially if said business is hiring (or planning to hire) remote talent from other states in the US, or all around the world. Deel’s local entities act as the legal employer to support you with compliance.

Most favoured features of Deel include:

- Entity registration in all 50 US states with full tax filings (W-2, 1099, etc.)

- Automated payments/invoicing

- Localized contract generation

- Localized tax management

- Compliance check

- Multi-currency payments

- Employee onboarding, transitions to full-time employment

Deel pricing also varies depending on the tier you choose. For example, Deel Contractor Management handles the whole contractor lifecycle for $49 per employee per month. Their most expensive tier Deel EOR will allow you to hire full-time employees globally without setting up local entities, but it will cost you $599.

Deel shines in reviews as “simple but powerful.” Users note that even visa sponsorship and country-specific taxes are baked in, so a new hire “can be fully onboarded in a few hours.” About 8,900+ reviewers give Deel a whopping 4.8 out of 5, with pros such as “ease of use,” “simple payments,” and “responsive support”.

Get DEEL and start hiring the best global talent easily

Gusto Payroll – Best for Tech-Savvy Start-ups

Gusto is the favorite payroll service of start-ups because it bundles payroll, HR, and time-tracking into a single, self-serve dashboard. Forbes describes Gusto as “a flexible all-rounder for 1-150 employees,” especially praising its plug-and-play additional features.

Stand-out features of Gusto Payroll include:

- Unlimited payroll runs with next-day direct deposit

- Automated federal, state, and local tax filings with e-signed W-2s/1099s

- Built-in time-tracking & PTO that syncs directly to payroll

- Payroll calculator (free to use)

- 100 + integrations (QuickBooks, Xero, Slack, Zapier) and open API for custom stacks

Gusto’s pricing starts at $49 per month + $6 per employee, and can increase up to $135 + $16.50 per employee, depending on your tier. All tiers are month-to-month and include unlimited payroll runs; Plus tier unlocks multi-state payroll and next-day pay, while Premium tier adds a dedicated success manager and advanced HR tools.

Real users gave 4.6 out of 5 stars for Gusto Payroll, praising “smooth onboarding” and an interface that “cuts payroll time to minutes.”

Get GUSTO and streamline every payroll run now

Lano – Best for Multi-Currency Contractor Teams

Lano is built for businesses that juggle a group of freelancers and full-timers across states and borders. It can support contracts for 170+ countries, pay in dozens of different currencies, and funnel every invoice into one audit-ready folder.

Here are Lano’s most favored features:

- Contractor management (with flat-rate onboarding)

- Ability to take legal liability in 170+ jurisdictions (instead of you)

- Auto-generated contracts and tax forms (location-specific)

- Multi-currency and bulk payments that clear in days

Lano Payroll’s pricing starts at $20 per contractor per month for the Contractor tier, climbs to $300 for multi-country payroll, and hits $625 per employee for full EOR coverage. Users give Lano payroll software 4.1 stars out of 5, while referring to it as “one platform for all payroll locations” and praising its “quick, responsive human support.”

Get LANO and simplify global payouts today

Paylocity – Best for Compliance-Heavy SMBs

Paylocity is a good fit for companies that are primarily worried about constantly changing payroll laws and compliance. It pairs a full-rounded payroll service with a dashboard that shows the live status of your company’s compliance and flags any I-9, ACA, and EEO deadlines. This way, you can see every red-yellow-green status at a glance.

Let’s take a look at Paylocity’s best features:

- Compliance dashboard with real-time alerts

- Automated tax filing plus year-end W-2/1099 prep

Built-in time & attendance that flows straight into payroll - An On-Demand Pay option that lets employees draw earned wages early

Paylocity sells on a quote basis. Costs change between $22 and $32 per employee per month, with some small teams starting around $39 per month plus $5 per employee. Although this is only for core payroll and tax services.

Paylocity’s real users rate the platform at 4.4 stars out of 5, often highlighting “robust reports” and the way compliance alerts “remove the guesswork from payroll taxes.”

Get PAYLOCITY and keep compliance on autopilot

Remote – Best for Lightning-Fast Global Onboarding

Remote payroll software brings forward its fast and error-free compliance at a global level. It has in-house entities in over 150 countries. It is perfect for companies that need to onboard international hires fast while staying compliant everywhere they operate.

Stand-out features of Remote include:

- One-click employee or contractor onboarding with locally compliant contracts

- Multi-currency payroll that auto-calculates local taxes and deductions

- Employer-of-Record (EOR) coverage in 150 + countries, removing the need for local entities

- Integrated expense, benefits, and equity management, plus 50 + HR/finance integrations

Like Paylocity, Remote also keeps its pricing modular. The contractor management module is $29 per contractor per month, while the full EOR service starts at $599 per employee per month. There are more affordable versions in between.

Users rate Remote to be 4,6 stars out of 5, praising “very well-designed” workflows and the ability to “get paid on time every single month without any hiccups.”

Get REMOTE and fast-track international payroll today

So, what’s the best payroll app for you?

Deel or Remote are ideal if global hiring is a possibility for you. Their all-in-one payroll management system handles contracts, taxes, and multi-currency pay in a few clicks.

Gusto is built for lightning-fast small business payroll in the U.S., while Lano excels at smoothing multi-currency contractor runs. Paylocity, on the other hand, is perfect for keeping compliance worries off your plate.

Now you know about it all. All you have to do is pick the best provider for your business and click subscribe!

FAQs

What is the meaning of payroll?

Payroll refers to the entire process of calculating what each worker earns, withholding certain taxes and deductions, and issuing their pay on time.

How does payroll software keep my business compliant?

A good payroll software auto-calculates federal, state and local taxes, files required forms, and updates rates whenever laws change, so you don’t miss deadlines or pay penalties.

Which payroll app is best for a start-up?

Gusto is popular for start-up teams because it offers unlimited runs, next-day direct deposit and time-tracking in one dashboard, but contractor-heavy shops often prefer Deel or Remote.

Do I have to withhold Delaware state tax if my employee works from another state?

Generally, you withhold tax based on where the work is performed, but if the employee’s “tax home” remains Delaware you may still owe Delaware withholding; check with a tax pro.

How much do payroll services cost?

Entry plans start around $29–$50 per month plus $6–$8 per worker for cloud platforms, while full Employer-of-Record services for overseas staff can reach $599 per employee.

What payroll taxes do I have to file in Delaware County?

Delaware employers must withhold state income tax and file an annual reconciliation (Form WTH-REC) by the last day of January.

Do these services handle Delaware new-hire reporting automatically?

Gusto, ADP and Paychex all include state new-hire e-filing; QuickBooks and OnPay require a manual export. Check the “state compliance” line in each plan’s feature grid.

How much do payroll services cost around here?

Flat-fee examples (June 2025): OnPay $49 + $6/employee; QuickBooks Core $50 + $6/employee; Gusto Simple $46 + $6/employee. (Provider websites & current price sheets.)

Can I run payroll myself to save money?

You can, but if you miss Delaware’s withholding deadlines you risk penalties. Even the state urges electronic filing to “save time and reduce errors.